As banks get involved with the blockchain, the federal government needs to set clear rules.

By Thomas P. Vartanian

The Wall Street Journal

The Trump administration recently approved the requests of five companies to establish national trust banks that can offer fiduciary services related to cryptocurrencies and digital assets. This was among actions taken by federal regulators last year permitting traditional and nontraditional financial institutions to engage in cryptocurrency activities.

Cryptocurrencies and blockchain products have brought efficiencies and advances to payments systems, but it would be a mistake to tout such benefits while glossing over crypto’s dark side. Criminals rely on cryptocurrencies to facilitate money laundering and other online crimes. While it is preferable for crypto to be under rather than outside the regulatory umbrella, until the industry is comprehensively regulated, new and dangerous risks will continue entering the financial system...

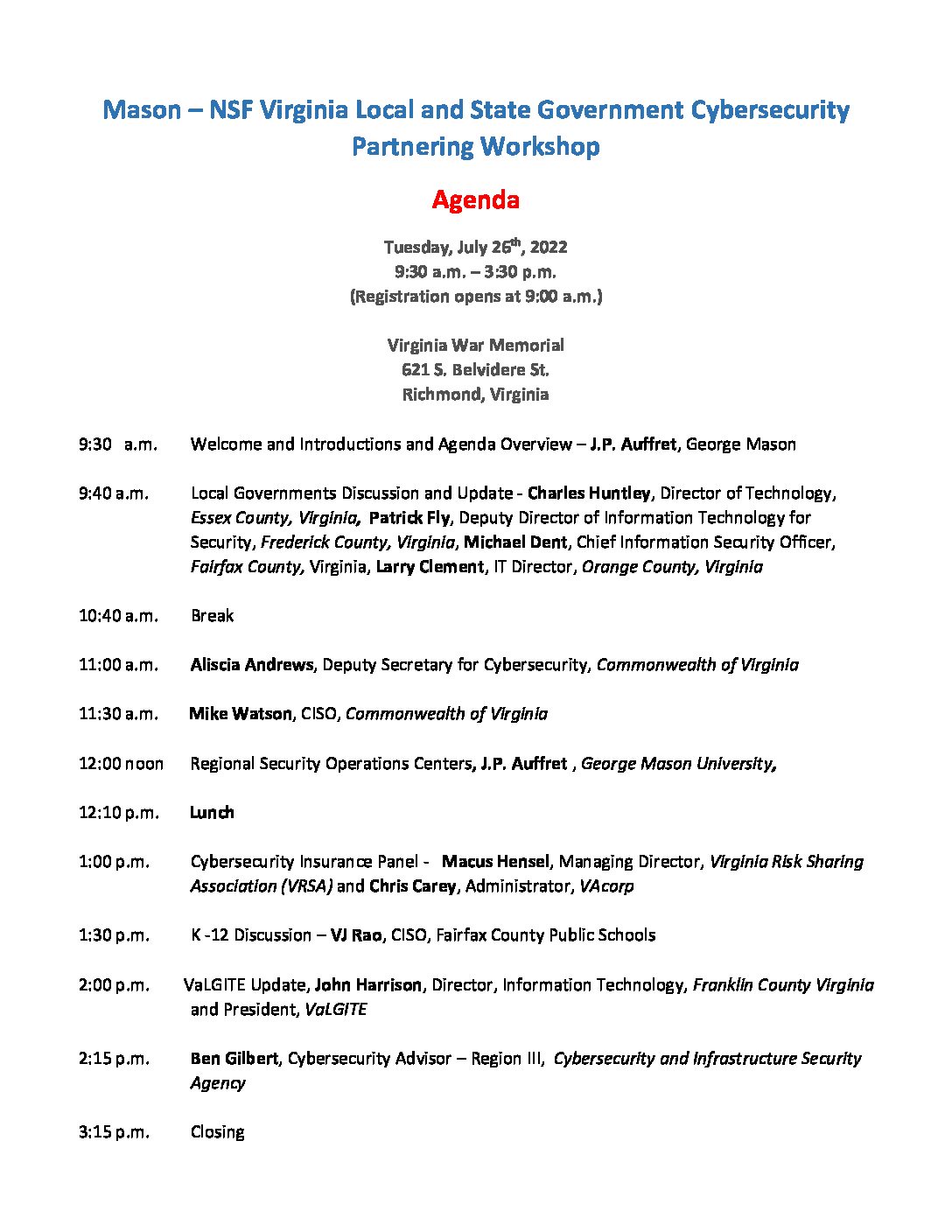

Northern Neck & Middle Peninsula – Mason & NSF Local Government Cybersecurity Partnering Workshop at the Historic Beale Sanctuary in Tappahannock, Virginia

Northern Neck & Middle Peninsula – Mason & NSF Local Government Cybersecurity Partnering Workshop at the Historic Beale Sanctuary in Tappahannock, Virginia

Please join us for the George Mason University Cybersecurity Innovation Forum on April 20, 2022 from 7-9pm at the Country Club of Fairfax. The Forum will consist of a series of 15-20 minute case study presentations by cybersecurity experts and technology innovators followed by a Q&A. The focus of the events is on cybersecurity innovation including innovation rationale and motivation, technology, metrics, and lessons learned.

Please join us for the George Mason University Cybersecurity Innovation Forum on April 20, 2022 from 7-9pm at the Country Club of Fairfax. The Forum will consist of a series of 15-20 minute case study presentations by cybersecurity experts and technology innovators followed by a Q&A. The focus of the events is on cybersecurity innovation including innovation rationale and motivation, technology, metrics, and lessons learned.